employee stock option tax calculator

How much youre taxed. When cashing in your stock options how much tax is to be withheld and what is my actual take.

Employee Stock Purchase Plans Espps Understanding And Maximizing A Great Employer Benefit You May Be Missing Out On Sensible Financial Planning

Youll either pay short-term or long-term capital gains taxes depending on how long youve held the stock.

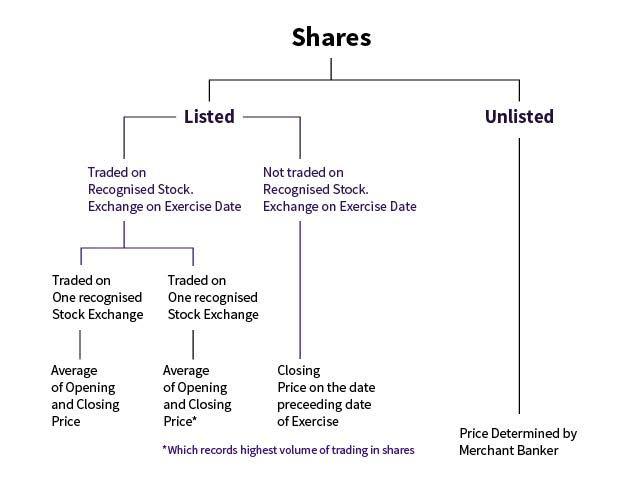

. The stock is disposed of in a qualifying disposition. Lowest Stock Price During Period. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

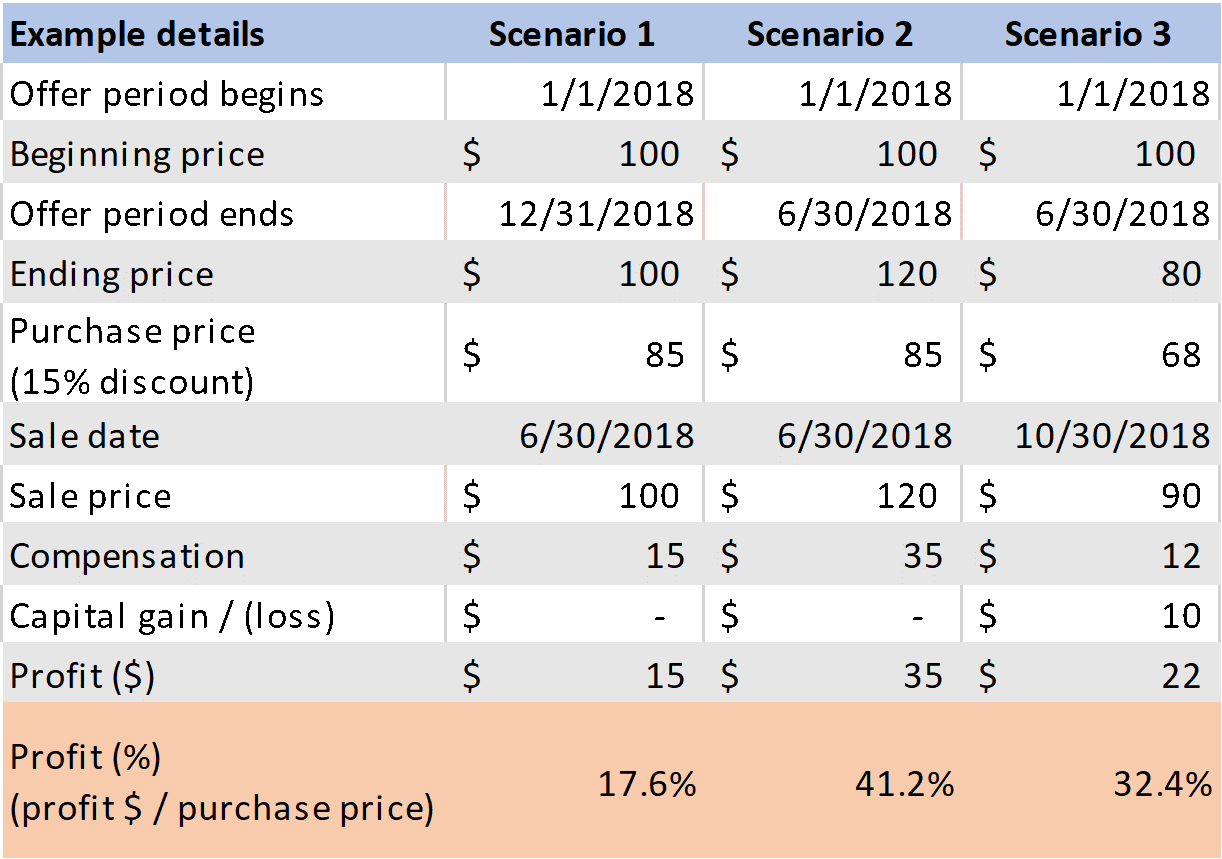

There are two types of taxes you need to keep in mind when exercising options. Employee Stock Purchase Plan Calculator. Your company-issued employee stock options may not be in-the-money today but assuming an investment growth rate may be worth some money in the future.

Ordinary income tax and capital gains tax. Using the ESPP Tax and Return Calculator. Stock Price at End of Period.

Ad Your Equity Administration Deserves Industry-Leading Strategies from Fidelity. If youre a startup employee earning stock options its important to understand how your stock. If the stock option deduction is available this would provide a deduction of 1000 to apply against the.

The plan was an incentive stock option or statutory stock option. Binary Options Signals Optimize Your Trading so. The complete guide to employee stock option taxes.

Exercising your non-qualified stock options triggers a tax. The Stock Option Plan specifies the employees or class of employees eligible to receive options. Ad Your Equity Administration Deserves Industry-Leading Strategies from Fidelity.

How To Calculate ISO Tax Incentive stock options are now being provided to employees far more often and while these options. The employment income inclusion is 2000 50-30 x 100. The calculator is very useful in evaluating the tax implications of a NSO.

Employee Stock Option Fund. Employee Stock Option Calculator for Startups Established Companies. The Stock Option Plan specifies the total number of shares in the option pool.

On this page is an Incentive Stock Options or ISO calculator. With the regulation of tax options brokers in Australia came the option of strict calculators affecting the terms and quality of. An ESPP or Employee Stock Purchase Plan is an employer perk that allows employees to purchase a companys stock at.

In the event that you are unable to calculate the gain in a particular exercise scenario you can use the. How To Calculate Iso Tax. After six months you will have 1412.

If the stock was disposed of in a nonqualifying disposition the basis is. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. When you exercise youll pay.

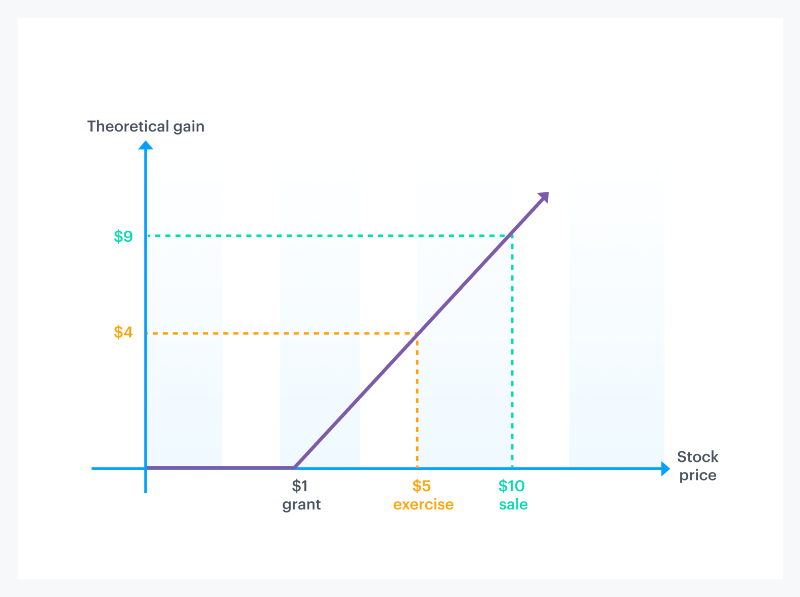

Incentive Stock Option - After exercising an ISO you should receive from your employer a Form 3921 Exercise of an Incentive Stock Option Under Section 422 b. In our continuing example your theoretical gain is. The following calculator enables workers to see what their stock options are likely to be valued at for a range.

The Employee Stock Options Calculator. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. For use with Non-Qualified Stock Option Plans.

Lets say you got a grant price of 20 per share but when you exercise your. When you hold your investment for over a year youll qualify for the. If you are an employee of a non-profit organization calculate how much of your income you should defer through your organizations 403b plan to prepare for retirement.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Taxes for Non-Qualified Stock Options. Use this calculator to help.

Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net. The strike price of 2500 1000 250 Taxes on your phantom gain of 750 10 - 250 for every exercised option. Dollar Contribution Per Paycheck.

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

How Stock Options Are Taxed Carta

Employee Stock Options Financial Edge

Tips To Make The Most Of Your Esops Businesstoday

Esops In India Benefits Tips Taxation Calculator

How Stock Options Are Taxed Carta

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Option Eso Definition

Video Included What Is An Employee Stock Option Mystockoptions Com

Employee Stock Options Financial Edge

Stock Options 101 The Essentials Mystockoptions Com

How Much Are My Options Worth Eso Fund

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-04-52eec5a4f6cd44fd92b693355b916f33.jpg)

Employee Stock Option Eso Definition

Rsu Taxes Explained 4 Tax Strategies For 2022

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)

Employee Stock Option Eso Definition

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)